Everyone wants to do their best to protect what’s important and what we most rely on, so we insure our homes, our cars, our phones, our pets, our gadgets and even our kitchen appliances.

But the most likely thing to be missing from the list is you!

Nobody wants to think about their own mortality or health but take a moment to think about how you or your family would cope if the worst happened? You can take simple steps to protect yourself and your loved ones to minimise the risks to your financial security.

Today’s insurance policies offer support when it’s needed most, but also a host of additional benefits that you wouldn’t expect including: children’s cover; 24/7 healthline for medical advice; mental health support; second medical opinion; global medical cover; nutritional advice.

As an experienced broker, I can advise you on a range of plans offering peace of mind so you and your family’s future is financially secure. By discussing your individual circumstances, including reviewing any existing policies, you will understand how much cover you need and why, and then be sure you have the right insurance policies in place.

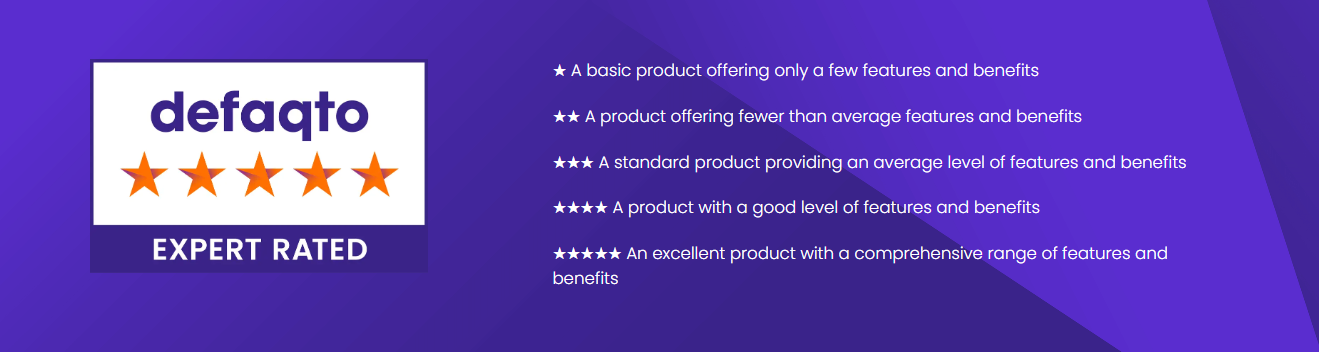

Not all insurance is equal, so when choosing your insurances A G Mortgages Ltd undertakes comprehensive research, including Defaqto Star ratings to help you find the quality cover you deserve, especially when it comes to a claim.

If you need convincing that life insurance is sensible choice, ask yourself this question: “If you were to die, how much money would your family have to live on?”

Many families would find themselves running short of money very quickly. Your income would disappear, but the household bills and mortgage repayments or rent costs would still need to be paid.

You may be employed and have work benefits, but typically this could be a lump-sum equal to 4 years’ salary, so how long would it last? If you’re self-employed or not working, State benefits are your only support.

A life assurance policy could provide a tax-free lump-sum to clear the mortgage, loans, credit cards or any other debts you may have. You could even have a monthly income paid to replace your own allowing your loved ones to maintain the sort of lifestyle you’ve achieved.

Today’s policies offer so much more including those highlighted in the additional benefits section so you don’t need to die to find life assurance offers you great protection. A tailor-made plan will provide peace of mind for you and your family.

There are a wide variety of critical illness, the most common being heart attacks, cancers and strokes. However, the most comprehensive of policies will cover around 50 conditions.

As with life assurance, you should ask “If you were to suffer a critical illness, how much money would you and your family have to live on?”

You may be employed and expecting your employer to take care of you, but most employers would only pay your salary or a reduced salary for a limited time, before you are moved to State benefits. If you’re self-employed or not working, State benefits are your only support.

A critical illness policy could provide a tax-free lump-sum to clear your mortgage, loans, credit cards or any other debts you may have, or to make needed alterations to your home so you and your loved ones could continue to live there. You could have a monthly income to replace your own allowing you and your loved ones to maintain the sort of lifestyle you want.

Today’s policies offer so much more including those highlighted in the additional benefits section so you don’t need to suffer a critical illness to find a policy that offers you great protection. A tailor-made plan will provide peace of mind for you and your family.

The majority of people will have been unwell at some time and taken a few days off work. How would you or your family cope if this illness was long-lasting?

According to Government data, in 2019 there were 1.97 million people long-term sick which has risen to 2.6 million people by July 2023, where long-term sickness is defined as a period of absence form work of 4 weeks or more.

The two most frequent causes to long-term absence from work are injuries to bones & muscles, and mental health issues, including stress.

You may be employed and expecting your employer to take care of you, but most employers would only pay your salary or a reduced salary for a limited time before you were moved to State benefits. If you’re self-employed, State benefits are your only support.

An income replacement policy could ensure you have sufficient income to meet your bills and protect a good part of your lifestyle. A tailor-made plan could compliment and existing employer benefits, but if you’re self-employed, you will need to make your own arrangements. Correct planning will give you and your family independent financial security and peace of mind.

Most policies in the past have been very limited as to what benefits they offered. Today’s life assurance, critical illness and income protections policies offer so many more “everyday” benefits. These include:

Children’s cover allowing you to protect your children under your own policy.

24/7 online GP access so you can avoid long waits for a GP appointment.

Annual health checks with a follow-up written report so you can prevent rather than cure.

Mental health services, so important when demand on the NHS and waiting times are so high.

Physiotherapy services.

Second opinions for medical advice.

Global cover allowing you to seek specialist advice or treatment in other countries.

Compare these options with the cover your current policy offers and if you want to improve your protection, a tailor-made policy could be ideal for you, providing peace of mind for you and your family.

Many people have pre-existing or inherited medical conditions that they believe will prevent them from getting life assurance, critical illness cover or income replacement cover. This is very often not the case.

Insurers have a variety of options available which could involve: excluding a pre-existing condition, excluding certain additional benefits, increasing the premium, or making no alteration to the standard policy.

As an experienced adviser, I will be able to collect your medical history, and with direct access to underwriters, will be able to discuss the situation and identify a likely outcome for your application. It might be the recommended policy comes from an insurer you’re familiar with or sometimes you may need a policy from a less well-know specialist company, but there are usually solutions to help you and your family to a more secure future.

If you couldn’t pay your mortgage due to an accident or illness, who would? Maintaining your mortgage payments is so important for keeping your home and the stability that brings to you and your family.

If you thought your medical history would prevent you getting protection, there are flexible policies available that would meet your mortgage payments for up to 24 months whilst you get back to full health, ready to return to work.

Your home may be repossessed if you do not maintain the payments on a mortgage or loan secured against it.

If you have a mortgage, your lender will insist on your home being insured. If you live in a flat, the freeholder will usually have a policy in place, but if you live in a house, you will need to make your own arrangements.

How will you know what level of cover you need? What additional benefits should you choose? Do you know the consequences for being under-insured? Is it better to combine buildings with contents into a single policy or have them separate?

With so many policies on the comparison sites, and so many options, how will you know if you have chosen a policy that is not only competitively priced, but offers a good quality cover?

With a comparison tool that compares available home insurance policies with the 5* Defaqto products you can check how your policy features and benefits compare. You will be able to see what is covered on your policy and also what isn’t.

Don’t wait to make a claim before you find out if your policy was the right one for you.

If you’re a landlord, you need to know property insurance will be good for you and your tenant. Your income depends on keeping your buy-to-let property occupied as much as possible and incidents that occur need to be resolved quickly.

A G Mortgages Ltd arranges 5* Defaqto landlord’s insurance which includes benefits such as: £1m building cover, £15k or £35k contents cover, loss of rent and alternative accommodation for your tenant, £2m legal liability cover, repairs guaranteed for 1 year, and much more.

With a comparison tool that compares available landlord insurance policies with the 5* Defaqto products you can check how your policy features and benefits compare. You will be able to see what is covered on your policy and also what isn’t. If your policy doesn’t do all that our recommended policy does, maybe it’s time to change so you keep your tenant happy and longer.

Don’t wait to make a claim before you find out if your policy was the right one for you.